Which of the Following Is the Most Diversified Investment Portfolio

For years many financial advisors recommended building a 6040 portfolio allocating 60 of capital to stocks and 40 to fixed. A diversified portfolio should have a broad mix of investments.

What Is A Diversified Portfolio John Hancock Investment Management

A diversified portfolio helps you and your startup funding process absorb the shocks of any financial disruption providing the best balance for your saving plan.

. Unlike the minimum variance portfolio approach the maximum diversification approach does not have a closed form solution. SPDR Portfolio Emerging Markets ETF NYSEARCA. A diversification of your investment.

The Risk Spectrum Of Various Investments. Vanguard FTSE Developed Markets ETF NYSEARCA. C One-year five-year and ten-year certificates of deposit.

B Municipal bonds issued by New York Houston and Chicago. In this kind of investment assets such as stocks fixed income and commodities react differently to the same economic event. Diversifying investments is touted as reducing both risk and.

When you own stock you own a part of the company. This conservative portfolio has 60 invested in a variety of equity funds 26 in bonds 7 in real estate and 7 in gold. Portfolio diversification and risk reduction.

Following are a few ways to diversify within an asset class. In recent years new portfolio construction techniques focused on risk and diversification rather than expected average returns have. One-year five-year and ten-year certificates of deposit.

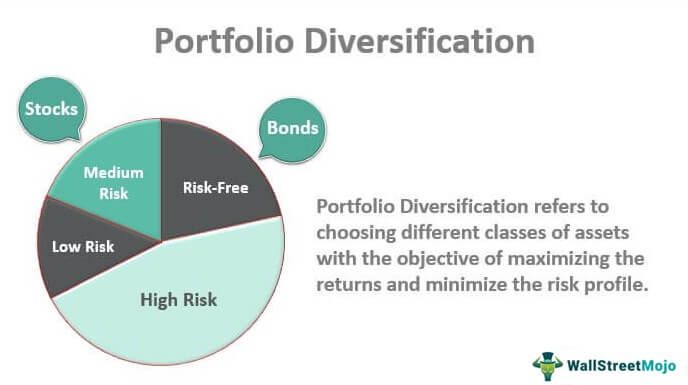

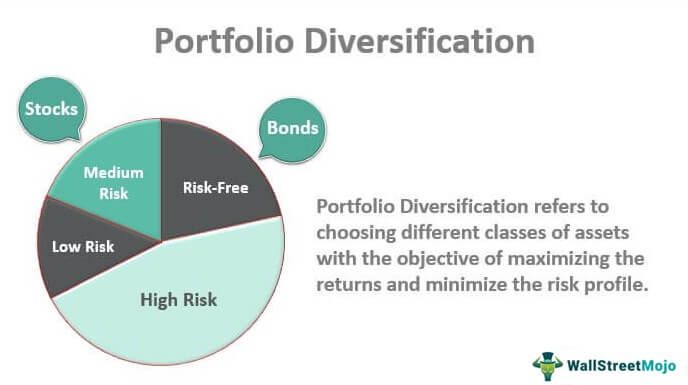

But thats not all. A diversified investment is a portfolio of various assets which earns the highest return for the least risk. Modern Portfolio Theory 20 - The Most Diversified Portfolio.

ARK Innovation ETF NYSEARCA. Stocks are an important component of a well-diversified portfolio. The portfolio under the set of constraints that the manager chooses that maximizes the value DP is the most diversified portfolio.

Diversity within asset classes. Which type of investment is most diversified. Lastly the portfolio rounds out its diversification with 20 in bonds 5 in gold and 5 in real estate equity trusts REITs.

Components of a well-diversified portfolio. A 100 shares of Wal-Mart stock an IBM bond and a two-year certificate of deposit. Diversified investment portfolios generally contain at least two asset classes.

5 No wonder the company reported revenues of 245 billion in 2020. D there is virtually no risk of loss. The following are the disadvantages of Diversified Investments.

To perform the maximum diversification portfolio optimization we. A mutual fund or index fund provides more diversification than an individual security does. A mutual fund or index fund provides more diversification than an individual security does.

It tracks a bundle of stocks bonds or commodities. B net asset value. Assuming an equal amount invested.

Municipal bonds issued by New York Houston and Chicago. 21 It is not a replacement for a well-diversified portfolio. ETFs because mutual funds do not exist that will provide the desired objective.

Most basic articles on personal finance advise investing in a diversified portfolio. The ________ is the market value of the securities that a mutual fund has purchased minus any liabilities. Vanguard Total Stock Market ETF.

These vehicles are diversified by. A well-diversified portfolio is generally more stable and less exciting so once they are settled into a variety of class then they can be there for extended periods and does not require a lot of maintenance. C meeting specific investment goals.

A mutual fund or index fund would be a diversified investment if it contained all six asset classes. Victor Bica angel investor confirms that a diversified investment strategy reduces risks. There exists a wide spectrum of investment opportunities that we can participate in from bond funds mutual funds REITs fixed-income funds endowment plans properties property speculation conventional businesses high-growth technology start-ups to stocks futures and options.

100 shares of Wal-Mart stock an IBM bond and a two-year certificate of deposit. These asset classes have varying levels of risk and returns so including investments across asset classes will help you create a diversified portfolio. Kason11wd and 2 more users found this answer helpful.

Disadvantages of the Diversified Investments. In our article we would like to review a maximum diversification portfolio with the following investment universe. Equal amounts of stock in IBM Intel and Microsoft.

Which of the following is the most diversified investment portfolioSelect one. Up to 256 cash back Which of the following is the most diversified investment portfolio. Founded by famed investor Warren Buffett Berkshire Hathaways holdings include big investments in industries ranging from technology Apple banking Wells Fargo Bank of America food and beverage Coca-Cola insurance GEICO and even clothing Fruit of the Loom.

In order to have a well-diversified portfolio its important to have the right income-producing assets in the mix. D Equal amounts of stock in IBM Intel and Microsoft. C gross asset value.

The best portfolio diversification examples include. A diversified investment portfolio includes different asset classes such as stocks bonds and other securities. Of the following types of mutual funds an investor that wishes to invest in a diversified portfolio of stocks worldwide including the US should choose A.

Maximum diversification portfolio optimization.

Diversified Portfolio How To Diversify Your Portfolio Quick Tips Marketing

Portfolio Diversification How To Diversify Your Investment Portfolio

Diversifying Investment Portfolio Why It Matters Fidelity

What Is Diversification How To Diversify Your Portfolio Ig En

Comments

Post a Comment